Avalanche

Summary

Avalanche was founded by Dr. Emin Gün Sirer, a former professor of computer science and networking systems at Cornell University, along with an experienced team from institutional finance, private markets, and technology. Launched in 2020 by Ava Labs, Avalanche creates custom blockchains and decentralized applications (dApps). Avalanche is compatible with Solidity, Ethereum’s programming language, and can be used to deploy different blockchains called “subnets.” Subnets allow developers to deploy highly customizable public or private chains which are interoperable with each other. Avalanche has a native, fixed-supply coin, AVAX, that is used for paying transaction fees and for staking in Avalanche’s consensus process. Transactions on the Avalanche blockchain cost around 0.001 AVAX, or about $0.09 at the current AVAX price, and the network can currently process 4,500 transactions per second. For a quick comparison, Ethereum (PoW) has a network speed (15-30 transaction per second) and cost ($40 or more) that is much greater than AVAX (PoS). Recently, Deloitte consultancy firm chose to partner with Avalanche to enhance the accuracy, speed, and security of the Federal Emergency Management Agency (FEMA) funding. Avalanche has shown itself to be more than a viable alternative to users looking for low cost, faster transactions, and higher scalability.

$AVAX

❖ $AVAX is a utility token that serves as the Avalanche ecosystem’s medium of exchange.

➢ The native token secures the network, pays for fees and provides the basic unit of account between the multiple blockchains deployed on the larger Avalanche network.

■ Market Cap: $21.1B

■ Volume (24Hr): $2.1B

■ Circulating Supply: 245.2M AVAX

■ Max Supply Cap: 720M AVAX

■ Market Cap Rank: #12

■ Performance for past year: +3,620% (Market: +184%)

Data from Coinbase on 2/8/2022 4:00PM

➢ Fees are not paid to any specific validator. Instead, the entire fee is burned, thus increasing the scarcity of the $AVAX.

Network

❖ Main Goals

➢ Build application-specific blockchains for both private and public deployments.

➢ Launch scalable and decentralized applications (dApps).

➢ Allow the building of complex digital assets with custom rules, covenants, and riders.

❖ The Avalanche Network combines features from Classical (speed and energy-efficient) and Nakamoto consensus (scalability and decentralization). See the figure below for comparison.

“Only three times in the 45-year-old history of distributed systems have we had a new family emerge. Avalanche is a brand-new family, as big of a breakthrough as Satoshi’s protocol was; it combines the best of Satoshi with the best of classical in scales like no other that allow anyone to integrate themselves into the consensus layer.” - Dr. Emin Gün Sirer

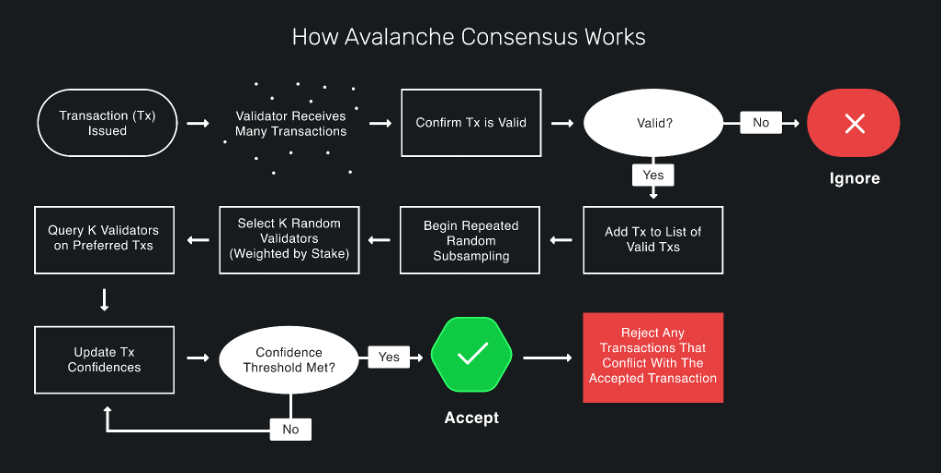

❖ Subsampled Voting System

➢ A large group of validators shares information to validate the transaction and agree to a decision. To determine whether a transaction should be accepted or rejected, it asks a small subset of validators whether they think the transaction should be accepted or rejected. If a large portion (α) of the validators agree that the transaction should be accepted, the validator approves the transaction.

❖ Consensus

➢ The consensus protocol does not need a main leader to reach consensus like in PoW, PoS, or DPoS (Delegated Proof-of-Stake). This allows for an increase in decentralization without sacrificing scalability.

❖ Fast Operation

➢ No matter how many nodes are involved in the validation, consensus is reached within a certain timeframe. Avalanche is generally able to permanently confirm transactions in under 1 second.

❖ Security

➢ Avalanche has 59.2% of its total value staked, ranking it fifth among all crypto assets by staked value. To attack the Avalanche network, one must obtain at least 80% of the tokens, which greatly improves the security of the network. This is well above the 51% standard of other systems.

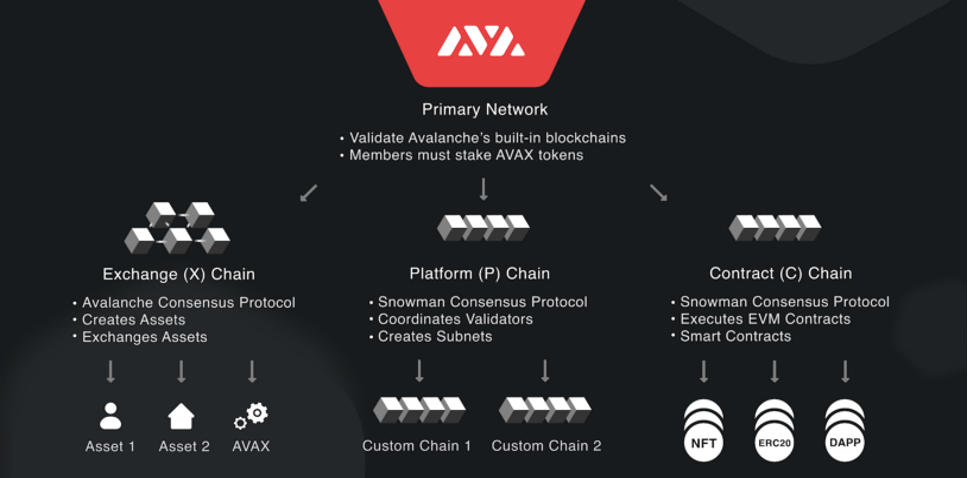

❖ Subnets

➢ Subnets are similar to sharding in ETH 2.0. A subnet is, essentially, a clone of the Avalanche Primary Network that’s connected to the platform when it’s launched. These subnets can be created on-demand to meet network traffic requirements and free up transactions. Avalanche can support an unlimited amount of new subnets, for subnets are able to create subnets indefinitely. Avalanche has 3 built-in blockchains: Exchange Chain (X-Chain), Platform Chain (P-Chain), and Contract Chain (C-Chain). These are all validated and secured by the Primary Network, a special subnet. See figure below.

❖ Token Bridge: The Avalanche Bridge (AB) can be used to transfer ERC-20 tokens from Ethereum to Avalanche’s C-Chain and vice versa. Third-party bridges include Allbridge and Saber, who have developed an Avalanche to Solana bridge.

Governance

❖ Any users holding tokens can vote on key financial issues and the evolution of the ecosystem.

❖ Avalanche’s on-chain governance is where participants can democratically vote on changes to the network and settle network upgrade decisions.

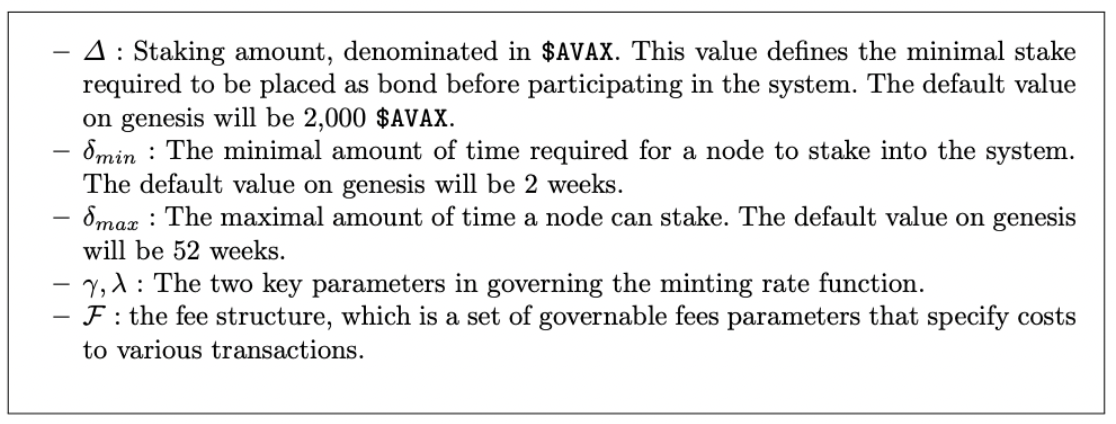

❖ Staking

➢ Staking rewards are made by on-chain governance, set by a function to never surpass the capped supply. To incentivize staking, staking rewards and fees can be increased or decreased.

dApps

❖ The Avalanche smart contracts platform has launched over 364 projects for decentralized applications in the last 14 months.

➢ Aave (AAVE)

■ Price: $253.84 | Market Cap: $3.4B

■ Aave is a DeFi protocol that allows users to lend and borrow crypto. Lenders earn interest by depositing digital assets into liquidity pools, and borrowers can use the lent crypto as collateral to take out a flash loan.

➢ Curve (CRV)

■ Price: $5.25 | Market Cap: $2.2B

■ Curve is a decentralized exchange for solely stablecoins. It uses an automated market maker (AMM) to manage liquidity and seeks to minimize fees, slippage, and impermanent loss through a focused pool of assets.

➢ Trader Joe (JOE)

■ Price: $2.28 | Market Cap: $336.9M

■ Trader Joe is a “one-stop” trading platform for the Avalanche user base. It also plans to expand into the lending space with “Banker Joe”, becoming an end-to-end DeFi provider in the future. JOE has traditional tokenomics, with a 40% split between the developer team and the treasury, and 10% for strategic investors. Rewards are given to holders of the JOE token who share in the trading fees.

➢ Crabada (CRA)

■ Price: $1.61 | Market Cap: $111.3M

■ Crabada is a crab-themed play-to-earn NFT game on Avalanche, where players create a team of three crabada to earn the currency Treasure Under Sea (TUS). Crabada plans to expand its gameplay modes to daily and monthly quests, integrate player and crabada levels, and launch on other blockchains.

➢ Pangolin (PNG)

■ Price: $0.7117 | Market Cap: $49.9M

■ Pangolin is a decentralized exchange (DEX) for Avalanche and Ethereum assets. It allows users to purchase the native Avalanche token AVAX using Apple Pay or Credit Credit, reaching a much larger audience of users. The project is community-owned and community-driven.

➢ Benqi (QI)

■ Price: $0.1469 | Market Cap: $47.8M

■ Benqi is a decentralized, non-custodial borrowing and lending protocol that offers the core functionality of a bank. Users can borrow and lend digital assets while earning interest, similar to Compound.

➢ Penguin Finance (PEFI)

■ Price: $1.62 | Market Cap: $24.7M

■ Penguin Finance is based on PancakeSwap, and it’s meant to bring yield-farming, staking, and other functionalities to Avalanche. PEFI presents users with a gamified design to encourage and enable them to pursue various DeFi investing strategies. The platform has games, such as Penguin Emperor and Penguin Arena, charity events, and NFTs.

Data from CoinMarketCap on 2/8/2022 at 4:00PM

❖ There are many more popular projects being created on the Avalanche Network. Check out the Avalanche Roadmap (2021 Roadmap | Avalanche) for more information.

Sources

- https://www.coinbase.com/price/avalanche

- https://coinmarketcap.com/

- https://docs.avax.network/learn/platform-overview/

- https://academy.shrimpy.io/post/what-is-avalanche-avax-the-next-defi-blockchain-explained

- https://defirate.com/avalanche-defi/

- https://www.avalabs.org/whitepapers

- https://www.cnbc.com/2021/11/23/what-to-know-about-ethereum-competitor-avalanche-as-avax-rallies.html

- https://www.gemini.com/cryptopedia/avax-coin-avalanche-crypto-ava-labs

By Tim Malloy

Feburary 18 2022

Disclaimer: This report is for educational purposes and should not be construed as investment advice. Additionally, the author may hold any of the assets mentioned.