What?

Maple provides capital to institutional borrowers through fixed income yield opportunities on the blockchain. They are working to redefine capital markets through digital assets by providing their users with the ability to earn interest and giving institutions the ability to borrow funds in a seamless manner. They increase the digital asset market by providing undercollateralized lending for institutional borrowers.

How?

Undercollateralized lending for institutional borrowers and sustainable yield sources by lending to crypto’s premier institutions like Amber, Alameda, Maven 11, Orthogonal, and BlockTower.

Maple is one of the most well-known crypto institutional borrowing platforms on the market.

The Maple protocol offers a capital-efficient option for institutional borrowing and fixed income lending in decentralized finance. Depositing cash into lending pools allowsfor lenders to gain consistent access to yields on the Maple finance protocol.

The Protocol

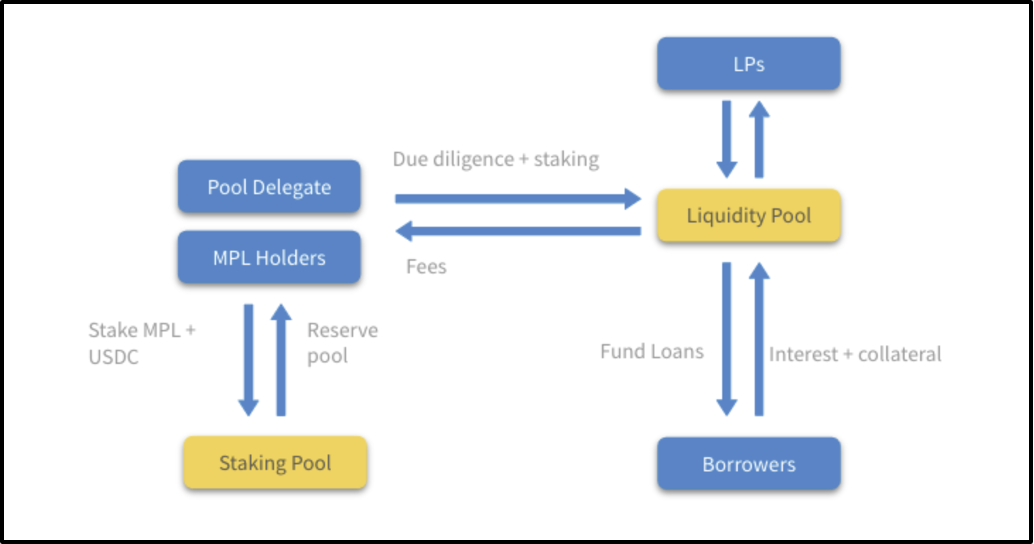

By depositing capital into Maple’s lending pools, users can access reliable yield opportunities that fluctuate depending upon terms set by the lender and whether or not a borrower defaults. These lending pools are managed by experienced investors, because typically it consists of wealthy/high income individuals who are able to create their terms and provide upfront capital for borrowers. They are chosen typically through a vetting process and KYC process.

The yields are sustained through:

- The diversification of the premier borrowers in the space who have a lot of capital invested

- They input the money and leave it in the hands of the delegates to do the due diligence

- Interest is accrued and reinvested to enable capital to compound over time

Process:

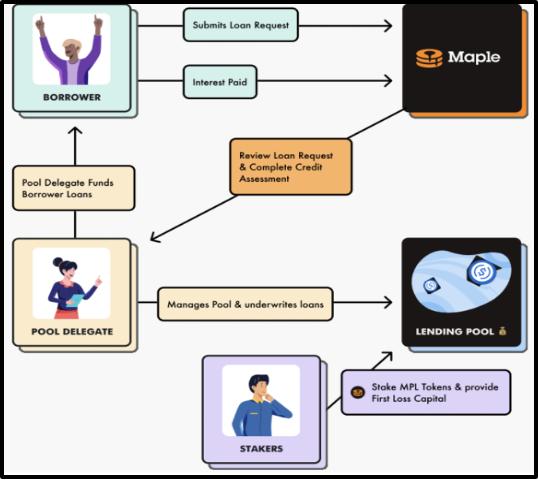

Borrowers may be able to access undercollateralized loans on Maple. Pool Delegates will assess loan requests and agree on interest and collateralization ratios with Borrowers. Prior to withdrawing funds, Borrowers will be required to deposit the agreed collateral to their Loan Vault. This collateral will be released after final repayments are made.

Maple allows lenders to generate yield by lending to top corporates & institutions in the crypto sector. Each Lending Pool funds loans to numerous Borrowers, offering Lenders access to diversified exposure. Maple is designed to be a set-and-forget solution for Lenders, as Pool Delegates conduct due diligence on Borrowers and manage the Pools.

MPT (Maple Token):

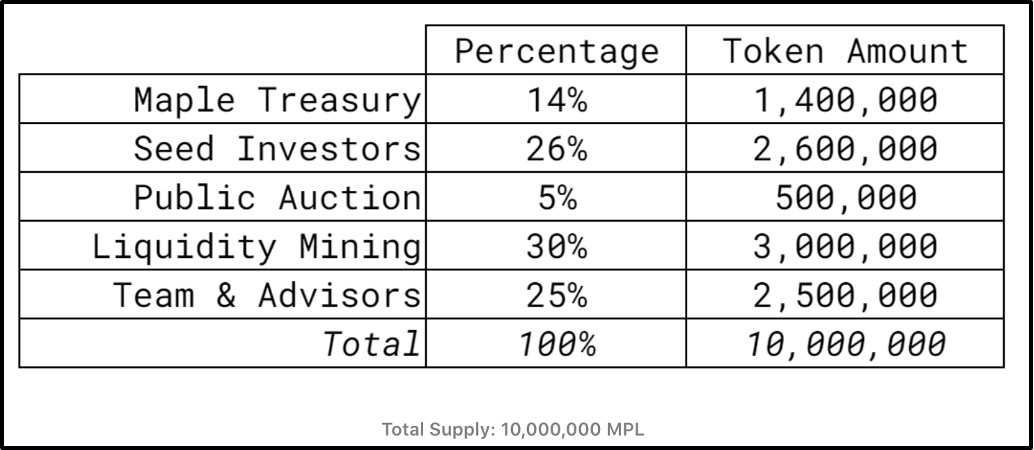

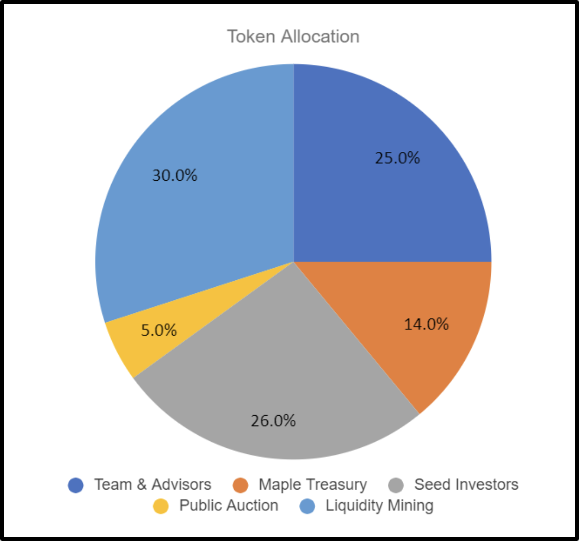

Market cap: $91m at the current price of $23.66. There are currently 2,501 holders of the token and a total supply of 10,000,000.

The token allows users to participate in governance in the operations of the protocol as well as receive rewards for partaking in the protocol and staking their funds. They can vote on changes to the protocols like fees, minting MPL tokens, and more.

Holders of the MPL token will also have the option to vote on what these fees will be used for as well, such as distributing to token holders or funding the treasury for further operational growth.

The way Maple finance distributes their fund is through the Maple treasury. The treasury receives a portion of funds generated by the protocol, which is a fee they receive when borrowers receive funding from Maple.

Lastly, lenders within the protocol can earn rewards by providing capital to the network, and staking their money into lending pools. The MPL token is 50:50 with USDC, to support the result of default and allow for the funds to be easily withdrawn. In the case that there was a default, Maple finance have loan pools typically in the billions across several lenders to mitigate any risk. In addition, pool delegates create their own underwriting system in determining a user’s creditworthiness to help mitigate any risk of defaults.

Staking

Users can deposit into Balancer, a decentralized exchange, where they will deposit MPL tokens and USDC so that they can receive the Balancer Pool Tokens, which they can deposit into different pools to receive fees and rewards.

Staking gives you 1/10th of interest in a pool + MPL rewards.

Lending

Rewards are based off:

- Average MPL price over preceding 7 days

- Target Staking Volume in the protocol for the next month- The staking reserve is calculated as protection in case of loan default and is about 8-12% of the loan balance in the pool.

- Target all in APY that month and the average interest rate on loans in the pool APY is calculated by taking the USDC fees plus the MPL rewards.

“Thus to achieve the target all-in APY of 15-20%, the target MPL rewards would be 5%-10% and the number of MPL deposited at the start of the month would be set accordingly.”

Value Proposition: The user will continue to pay what they borrow, no matter how much the market fluctuates. Maple promises that you will not have to deal with losing or changing your collateral.

Improvement: Currently the barrier to entry is very high for borrowers because they offer under collateralized loans and need to be certain that their funds are not lost or a borrower does not default, so right now they only offer the product to blue-chip- investors or individuals who have exemplified extreme profitability, which mitigates a large amount of risk. Their plan is to keep growing and scaling their product, and eventually offer this product to more individuals in the space.

By Kristian Lamarre

Feburary 20 2022

Disclaimer: This report is for educational purposes and should not be construed as investment advice. Additionally, the author may hold any of the assets mentioned.